FREQUENTLY ASKED QUESTIONS

What is the Section 179 Deduction?

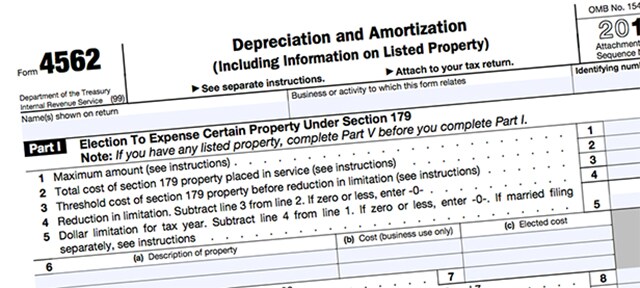

A. Essentially, Section 179 of the IRS tax code allows businesses to deduct the full purchase price of qualifying equipment and/or software purchased or financed during the tax year. That means that if you buy (or lease) a piece of qualifying equipment, you can deduct the FULL PURCHASE PRICE from your gross income. It's an incentive created by the U.S. government to encourage businesses to buy equipment and invest in themselves.

Which property qualifies under Section 179?

A. Most business equipment qualifies for the Section 179 deduction. This includes tangible goods like vehicles, machinery, computers, software, and office furniture. The IRS website has a full list of equipment that qualifies for the Section 179 Tax Deduction. To qualify more than 50% of the property's use must be in the service of a trade or business.

How much can you deduct?

A. When your business buys certain items of equipment, it typically gets to write them off a little at a time through depreciation. In other words, if your company spends $50,000 on a machine, it gets to write off (say) $10,000 a year for five years (these numbers are only meant to give you an example).

Now, while it's true that this is better than no write-off at all, most business owners would really prefer to write off the entire equipment purchase price for the year they buy it.

In fact, if a business could write off the entire amount, they might add more equipment this year instead of waiting over the next few years. That's the whole purpose behind Section 179 - to motivate the American economy (and your business) to move in a positive direction. For most small businesses, the entire cost can be written-off on the 2017 tax return (up to $1,000,000).

What are the limits of Section 179?

A. Section 179 does come with limits - there are caps to the total amount written off ($1,000,000 in 2018), and limits to the total amount of the equipment purchased ($2,500,000 in 2018).

*The information provided here is intended as a general overview of the Section 179 Deduction. You should always consult with a tax professional on business tax deductions.